Kenya Power has reported a profit after tax of Sh24.5 billion for the financial year 2024/25, representing an 18.7% drop from the Sh30.1 billion posted in the previous year. The decline was attributed to lower electricity tariffs, reduced foreign exchange recoveries, and higher finance costs associated with currency stabilisation efforts.

Higher Electricity Sales Support Profitability

Despite the dip in profits, the utility company saw a notable increase in electricity sales. Kenya Power sold 11,403 GWh of electricity during the year—an 8% increase, translating to 887 GWh more than the previous year. Meanwhile, total unit purchases rose by 787 GWh, highlighting a growing demand for electricity across the country.

Cost of Sales Declines by 4%

The company also benefited from a 4% reduction in the overall cost of sales, falling from Sh150.6 billion to Sh144.6 billion. This resulted in a cost saving of Sh5.94 billion, largely credited to the stabilisation of the Kenyan shilling against major foreign currencies, in which most Power Purchase Agreements (PPAs) are denominated.

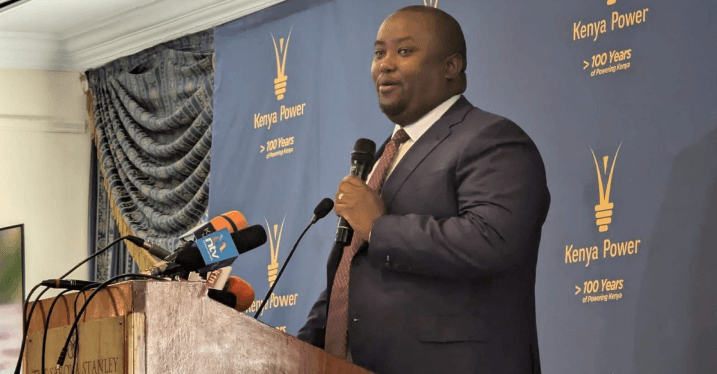

CEO: Lower Tariffs Driving Consumption and Growth

Kenya Power’s Managing Director and CEO, Joseph Siror, noted that reduced base tariffs over the last two years have supported increased electricity consumption among customers.

The base tariff has been coming down, reflecting the government’s commitment to lowering the cost of electricity. This is a positive move for consumers, making it more affordable to consume more electricity.“As we sold more units at lower prices, we remained profitable thanks to economies of scale

Joseph SorirOperating Expenses and Credit Losses Decline

Operating expenses also dropped by Sh3.86 billion, supported by a decrease in expected credit losses. This was a result of improved macroeconomic conditions and better customer payment behavior, further enhancing Kenya Power’s bottom line.

Dividend Payout and Share Price Rally

For the second consecutive year, Kenya Power is rewarding its shareholders with dividends. The board of directors has recommended a final dividend of Sh0.80 per ordinary share, in addition to an interim dividend of Sh0.20 per share issued earlier this year.

Indeed, Kenya Power’s share price surged by over 900%, climbing from Sh1.38 in December 2023 to more than Sh15, underscoring renewed optimism in the company’s long-term outlook.

Customer Base Crosses 10 Million

On the customer front, Kenya Power connected 401,848 new customers, pushing its total customer base beyond 10.1 million. The company also improved its distribution and transmission efficiency, rising to 78.8% from 76.8% the previous year, thanks to ongoing grid upgrades and system reinforcement initiatives.

Focus on Operational Efficiency and Grid Modernisation

Looking ahead, Kenya Power has reaffirmed its commitment to:

- Enhancing operational efficiency

- Strengthening liquidity and

- Delivering reliable, affordable, and sustainable electricity to all Kenyans

The company is also prioritising grid modernisation, accelerated customer connections, and digital transformation to improve customer experience, boost revenue assurance, and support a smarter, more resilient energy network.