The Kenya Power and Lighting Company (KPLC) has reported a pre-tax profit of Ksh.14.83 billion for the six months ending December 31, 2025, marking a 5.5 per cent increase from the Ksh.14.06 billion recorded over a similar period in 2024. The power utility attributed the improved performance to higher electricity sales, strong demand, and lower finance costs, alongside gains made through improved efficiency in power distribution.

Electricity Sales and Revenue Rise

According to KPLC, revenue from electricity sales rose by 6.9 per cent, climbing from Ksh.107.42 billion to Ksh.114.87 billion during the review period. The company said increased consumption across customer segments played a key role in driving the growth. Electricity demand remained strong throughout the half-year, resulting in a Ksh.5.33 billion increase in power purchase costs. Total energy purchases grew by 8.3 per cent to 7,807 gigawatt-hours (GWh).

Improved Efficiency and Reduced Borrowing

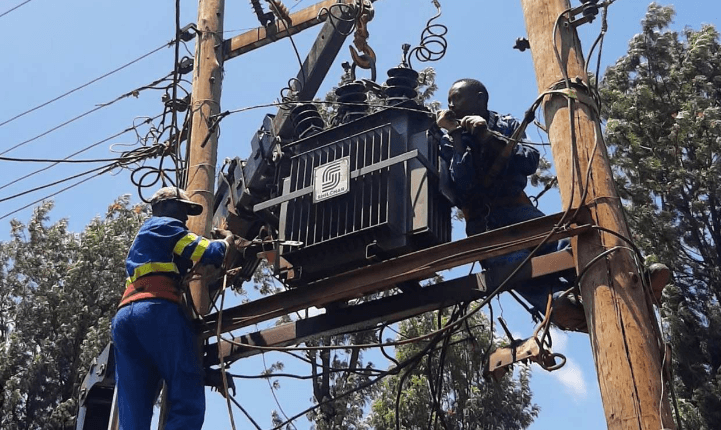

Kenya Power also reported progress in operational efficiency. Total electricity unit sales increased by 10.5 per cent to 6,086 GWh, while distribution efficiency improved from 76.35 per cent to 77.97 per cent, reflecting enhanced network performance and ongoing loss-reduction measures. At the same time, the company reduced its borrowing by 6 per cent, bringing total loans down to Ksh.84.23 billion, easing pressure from finance costs. Kenya Power Managing Director and CEO Eng. Joseph Siror said the results demonstrate the impact of sustained investments in network improvements and prudent financial management.

The utility says it remains focused on strengthening its distribution network, improving service delivery, and supporting the country’s growing electricity demand as part of Kenya’s broader economic development agenda.